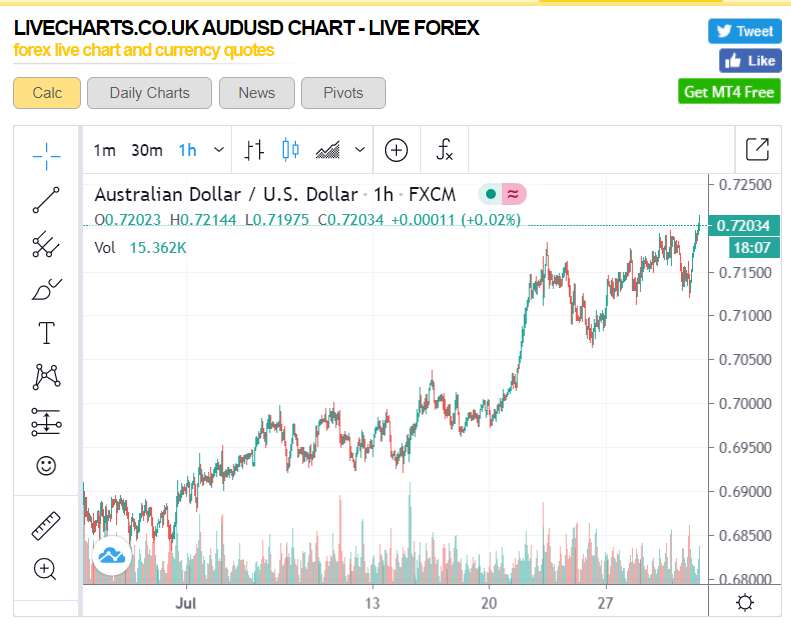

The Australian Dollar rebounded from its overnight low’s yesterday at 0.71207 to finish in New York at 0.7198. In early Asia, the Aussie extended its climb higher, setting currently at 0.7203. The weaker US Dollar has once again rescued the Aussie Battler. Yesterday’s Australian economic data releases saw Building Approvals fall to -4.9%, weaker than median forecasts for a -2.0% fall. Australia’s new coronavirus cases continue to rise with new hotspots appearing across Sydney. Victoria continues to struggle to control its own outbreak where 723 new cases and 13 deaths were reported yesterday.

The spotlight today falls on Chinese Manufacturing and non-manufacturing PMI’s (11.30 am Sydney, 0.130 GMT) as well as Australia’s Q2 PPI report. China’s Manufacturing PMI is expected to ease in July to 50.8 from 50.9 in June. Non-Manufacturing PMI’s are forecast to slip from 54.4 to 51.2. Australia’s Q2 PPI is expected to improve to 0.3% from Q1’s 0.2%. A disappointment in the data coupled with the growing coronavirus count in the country will keep a lid on the Aussie.

AUD/USD has immediate resistance at 0.7220 followed by 0.7250. There is immediate support for the Battler at 0.7170 followed by 0.7140 and 0.7120. Look for consolidation today within a likely 0.7120-0.7220 range. Prefer to sell rallies, we could see further corrective moves lower today.