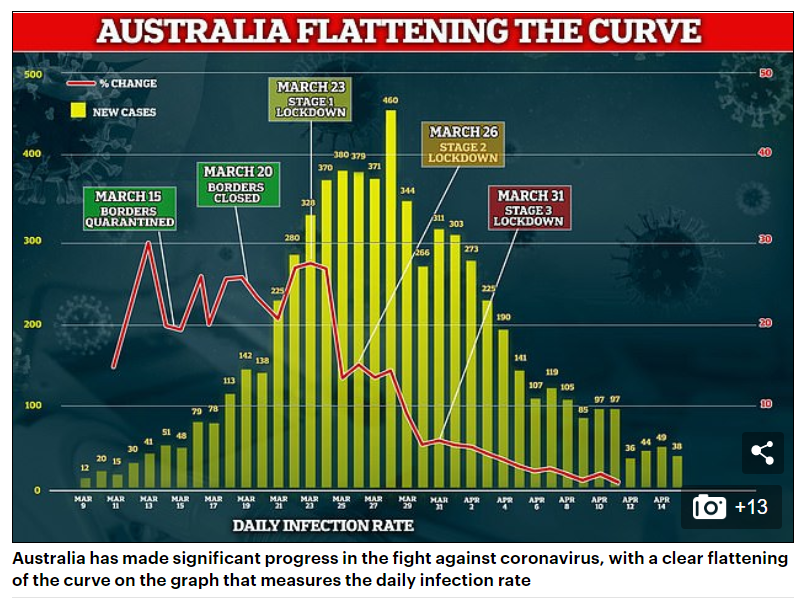

The Australian Dollar held its own, managing to eke out a gain versus the overall stronger US Dollar. AUD/USD closed at 0.6340 from 0.6320 yesterday. In early Friday morning Sydney trade, the Aussie Battler climbed to 0.6385 on the rise in risk assets following breaking news that clinical trials of a drug (Gilead’s Remdesivir) showed success through “rapid recoveries” in Covid-19 patients taking part in the trial. Meantime Australian PM Scott Morrison and his Cabinet signalled an exit strategy for the current lockdown although current restrictions would remain in place for at least 4 weeks. Australia has made significant progress in the battle against coronavirus, with the daily infection rate curve flattening.

AUD/USD has immediate support at 0.6320 followed by 0.6280 (overnight low traded was 0.6364).

Immediate resistance can be found at 0.6400 and 0.6450. The Battler looks like its building a base to test higher. It will need to see an overall US Dollar weakness as well as a rally in Asian and Emerging Market currencies. The spotlight today is on China’s Q1 GDP and trifecta of economic reports, Industrial Production, Retail Sales and Fixed Asset Investment. Although traders are often sceptical on the data, there are still reaction in the currency. Look for a likely range today between 0.6250 and 0.6450. Prefer to buy dips, the US Dollar will not remain “king” of FX for too long in the current environment.