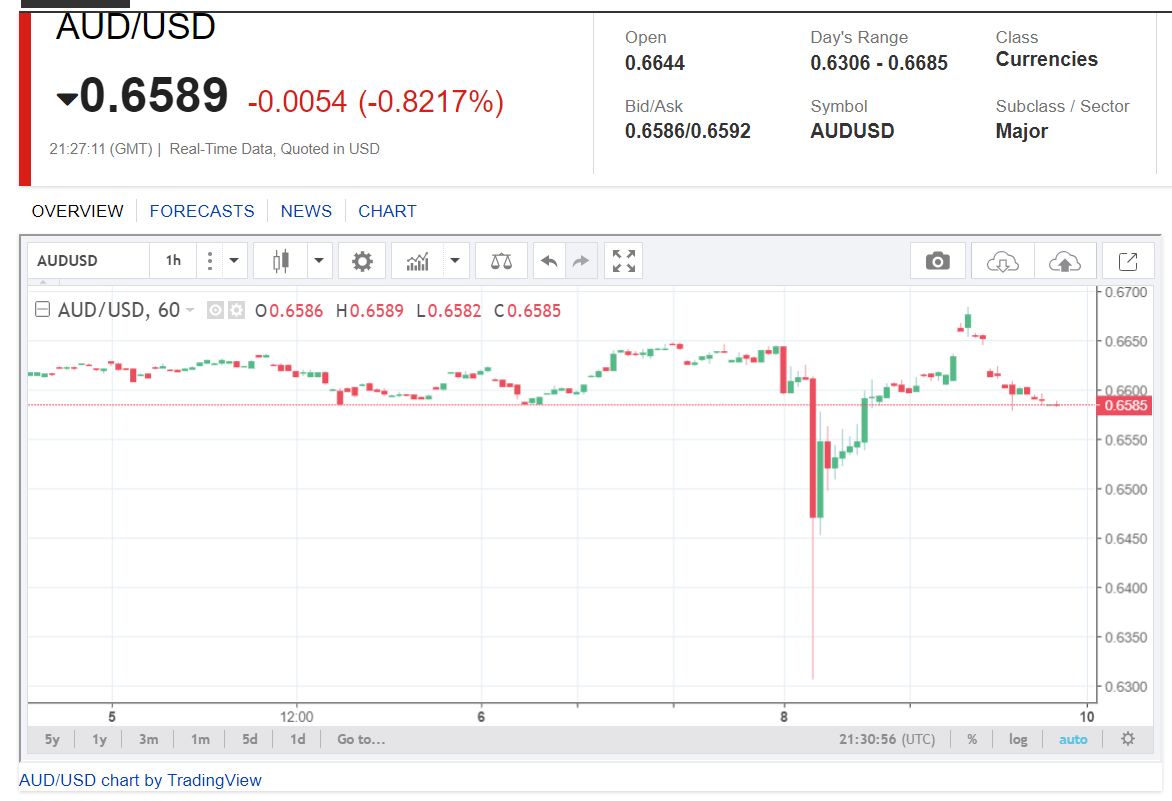

The Aussie survived its flash crash plunge to 0.63111 before jumping like a kangaroo on fire back above 0.66 cents to 0.6620. AUD/USD then settled to trade in a 0.6580-0.6630 trade before spiking to an overnight high at 0.66848 as US bond yields plummeted.

Australia’s 10-year treasury yield finished at 0.61%, down six basis points from yesterday. This contrasts with the big 26 bp move lower in the US 10-year rate. At the start of 2020, US 10-year yields were at 1.87% with Australian 10-year rates at 1.34%. This gave the US a 53-basis point advantage. Overnight US 10-year rates fell below that of its Australian counterpart. There is now a five-basis point advantage in Australia10 year yields. AUD/USD downside is now limited.

Speculative market position saw net Aussie short bets increase to -AUD 43,852 contracts from -AUD 37,477. Current market positioning further limits the AUD/USD downside.

AUD/USD has immediate support at 0.6570 and 0.6520. Immediate resistance can be found at 0.6640 and 0.6670. Look for a likely range of 0.6560-0.6660. Prefer to buy dips.