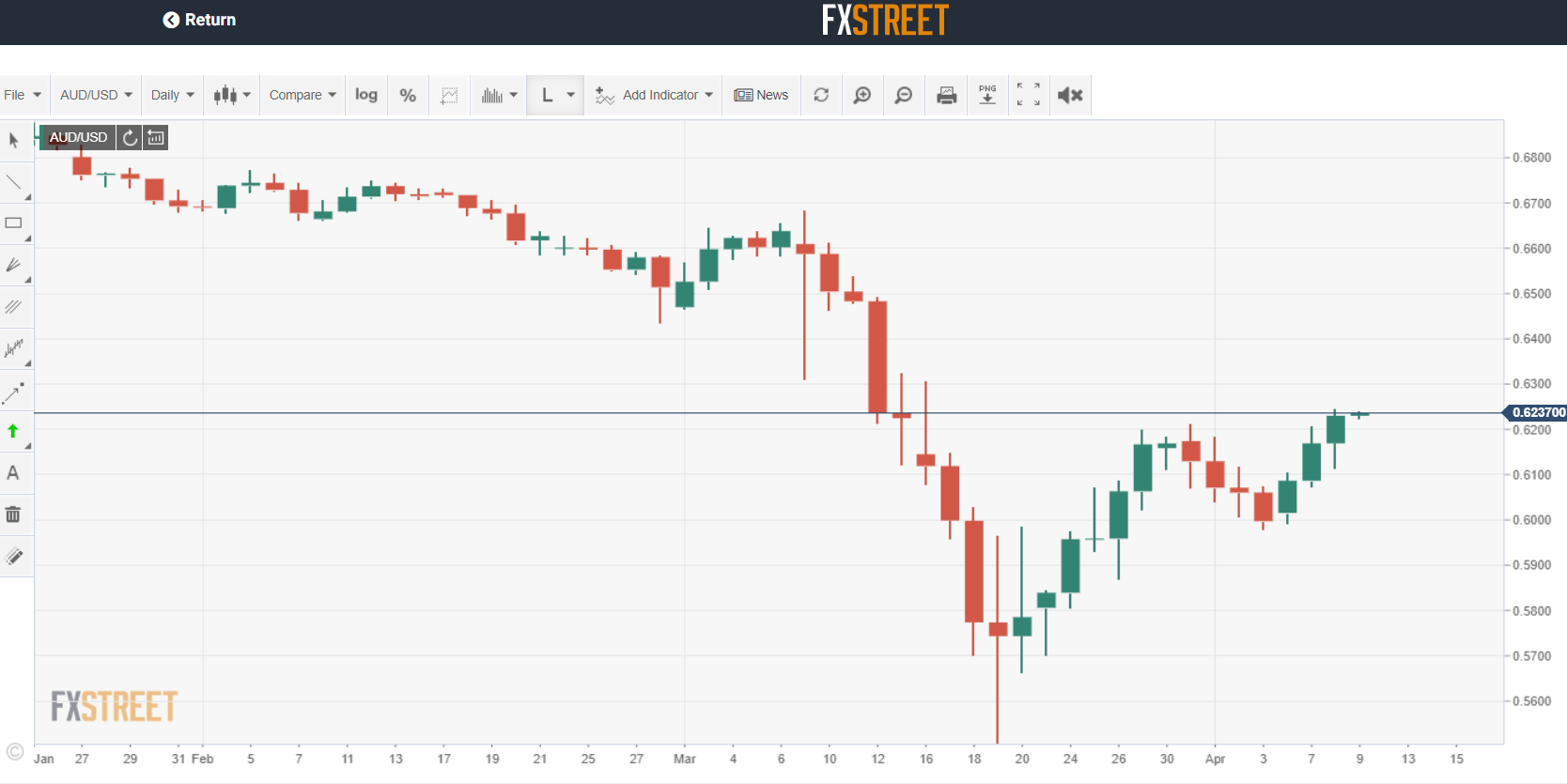

The Australian Dollar rocketed higher following an overnight drop to 0.61158 in early Europe after ratings agency Standard and Poors cut Australia’s credit rating outlook from AAA stable to negative. AUD/USD hit a fresh 3-week high at 0.62449 before easing to settle at 0.6233 in late New York. Good buying interest entered near the 0.6110 level as speculative shorts ran to cover as the Aussie rallied.

Markets interpreted the RBA’s rhetoric on QE as a likely taper, following the Australian central bank’s decision to keep interest rates unchanged. The Australian government also planned further stimulus to aid jobs. The rise in risk assets also boosted the Aussie Dollar.

AUD/USD has immediate resistance at 0.6250 followed by 0.6290. Immediate support can be found at 0.6200 and 0.6160. Look for a likely range today of 0.6150-0.6250. Just trade the range on this one today, things could turn on a sixpence.