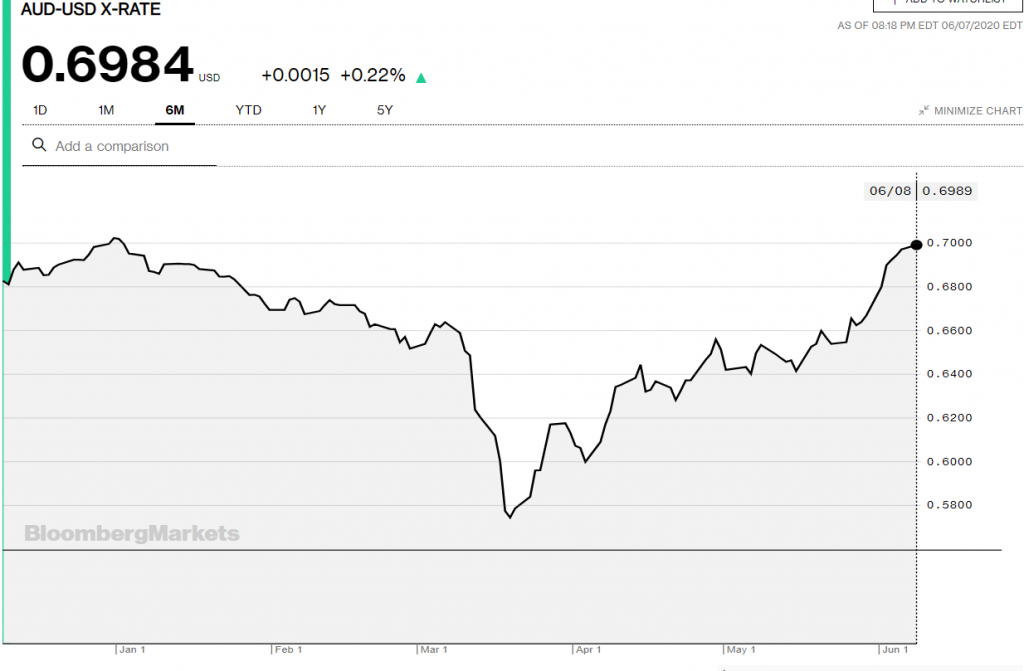

The Australian Dollar’s 7-day rally saw the Battler surge 4.5% last week, peaking at 0.70130 on Friday afternoon, its highest since January 3. Overnight, the Aussie Battler slumped to an overnight low at 0.69307 before rallying back to close at 0.6767 in New York. Better than forecast Chinese Trade data released yesterday saw the AUD/USD trade to 0.70035 this morning in Sydney before settling at its current 0.6992.

The rise in China’s trade surplus was due to a less than expected fall in exports, down 3.3% in USD terms from a year earlier, helped by an increase in medical related sales. Imports plunged 16.7% due mainly to a fall in import prices. Which shows that the Chinese economy is recovering slowly from May’s coronavirus slump. The rising risk of an escalation in US-China trade relations threatens the outlook for China’s trade.

The yield differential between US and Australian 10-year bonds have narrowed in favour of US rates. Which also sees the AUD/USD upside momentum waning. AUD/USD has immediate resistance at 0.7020 followed by 0.7050. Immediate support can be found at 0.6960 followed by 0.6930. Look to sell rallies in a likely range today of 0.6920-0.7020.