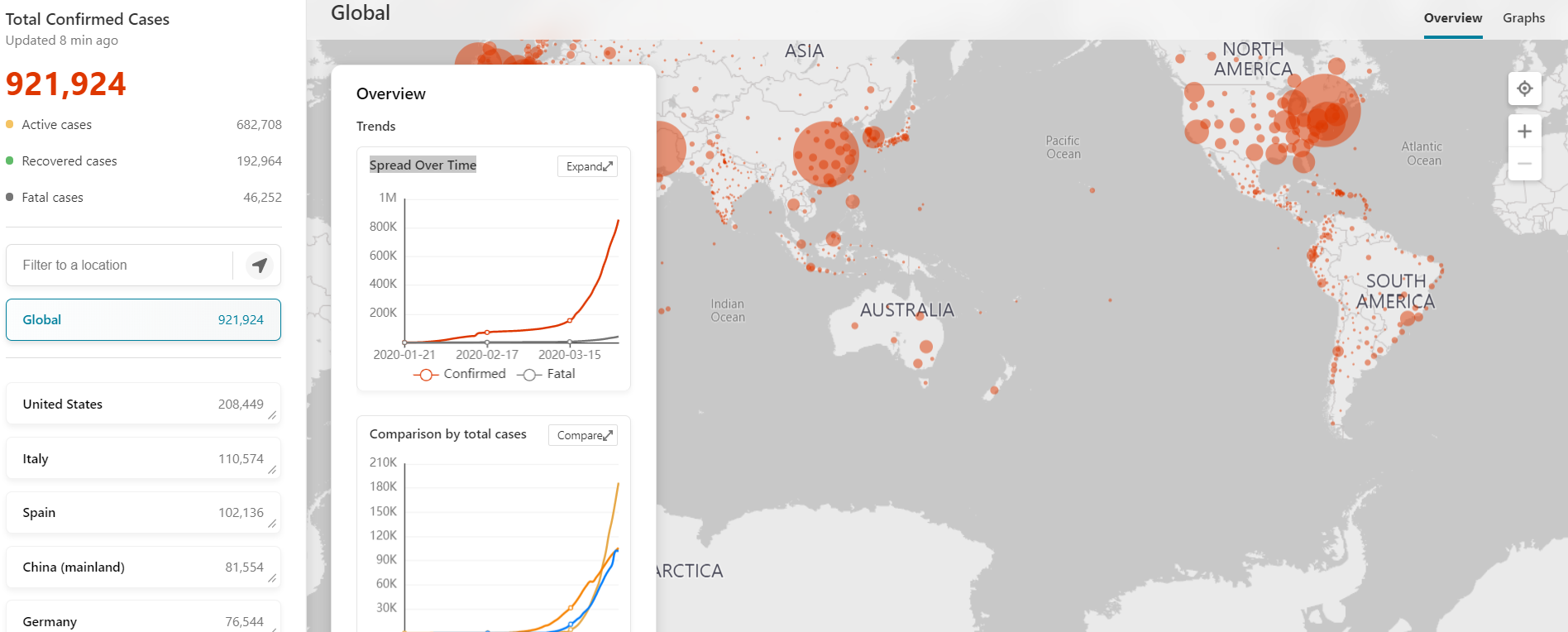

Summary: Killer Dollar returned to kick off Q2 2020 sinking Emerging Market and Risk currencies, climbing against the majors (except the Yen) in high volatile trade. The coronavirus crisis plagued risk sentiment despite fresh efforts by the Fed to provide USD liquidity to global central banks. While US economic data bettered expectations, a warning by President Trump that Americans face a “painful” two weeks ahead in fighting Covid-19 soured risk sentiment. Risk currencies, the Australian Dollar and Canadian Loonie tumbled 1% to 0.6075 (0.6145) and 1.4235 (1.4095), respectively. The Euro retreated 0.7% to 1.0955 from 1.1039, after dropping to an overnight low of 1.0903. Sterling slipped to 1.2395 from 1.2417. Against the safe–haven Yen, the US Dollar was 0.37% lower to 106.98 (107.54). It was against the Emerging Market currencies that the killer Dollar did its damage. The Dollar skyrocketed 2.3% against the South African Rand, USD/ZAR closed at 18.24 in New York from 17.87 yesterday. USD/CNH (Dollar-Offshore Chinese Yuan) climbed to 7.1295 from 7.0945. The Dollar jumped 1.21% against the Thai Baht, breaking the 33.00 barrier to settle at 33.08 (32.75) in late New York. USD/INR (Dollar-Indian Rupee) soared 1.45% to 76.4 (75.35). The Dollar Index (USD/DXY), a favoured gauge of the US currency’s value against 6 foreign currencies climbed to 99.487 from 99.080. Equities resumed their falls with the DOW losing 4% to 20,955. (21,921) while the S&P was at 2,474. (2,590.) down 3.9%. Treasury yields tumbled. The benchmark US 10-year bond yield was 5 basis points lower to 0.61%. Germany’s 10-year Bund finished at -0.47% from -0.48% yesterday. Australia’s 10-year note rate closed at 0.65% (0.74%).

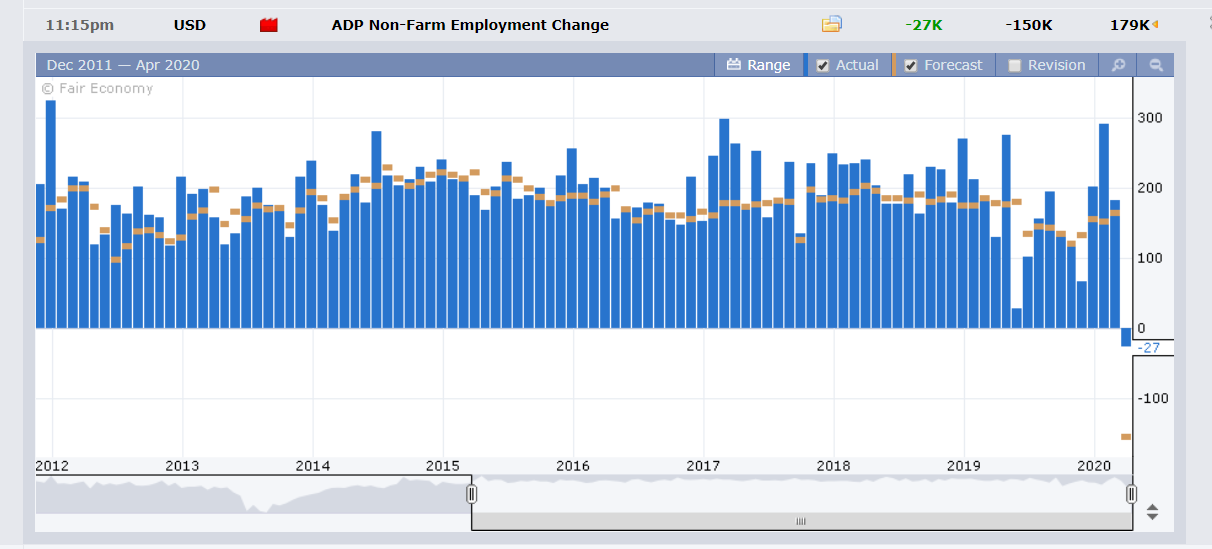

Data released yesterday saw China’s March Caixin Manufacturing PMI climb to 50.1 from February’s 40.3, beating expectations of 45.0. Japan’s Tankan Manufacturing Index fell to -8% in March, beating forecasts of -10. Germany’s Retail Sales rose 1.2% from the previous month’s 0.9%. UK Final Manufacturing PMI climbed to 47.8, bettering forecasts of 47.1. US ADP Private Employment fell in March by 27,000 from February’s 183,000 rise, the first fall since September,2017. However, the drop bettered expectations of a 150,000 fall. US ISM Manufacturing Index bettered forecasts of 48.2 to 49.1 although the new factory orders component fell to an 11-year low.

On the Lookout: Expect Asian markets to remain defensive following the risk-off sentiment offshore.

The rise in the global toll of Covid-19 cases, extended lockdowns, and bleak comments from key officials and policymakers will continue to weigh on risk and support the Dollar.

Markets will focus on this week’s US Unemployment Claims number after last week’s surge and ahead of tomorrow’s key US Payrolls report.

Events and economic data releases are relatively light today. Japan’s annual Monetary base report is the lone data release from Asia. The UK Nationwide House Price Index kicks off European data. Swiss CPI, Spanish Unemployment Change, and Eurozone PPI follow. US data start off with March Challenger Job Cuts, Weekly Unemployment Claims (median forecast 3,500 K from last week’s 3,283K), US Trade Balance, and Factory Orders. Canada reports it’s March trade balance.

Trading Perspective: Expect Asia to trade defensively today in volatile conditions. Yesterday’s average range was between 125-150 pips in the majors, depending on the currency. Liquidity conditions are different for various currencies. The spotlight will be on the Asian and Emerging Market currencies. Both the US ADP Employment Report and ISM Manufacturing PMI bettered expectations. Ahead of tomorrow’s key US Payrolls number, the Dollar will remain in demand.

That said, in these markets, nothing goes in a straight line for too long. Trade extremes, be discretionary and pick your levels well.