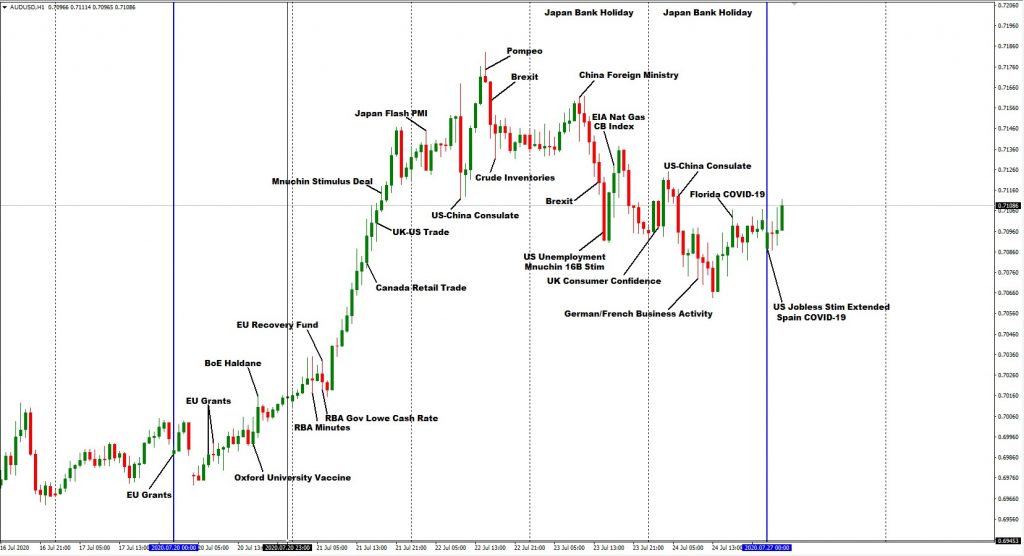

Last week the Australian Dollar spent most of its time in the 0.71000 range against the United states Dollar. Much of the news throughout the week that was dominating headlines was again on the topic of COVID-19, there were some other outliers with impacts on price such as Brexit and the current developments between the US and China. For the Australian Dollar though the Reserve Bank of Australia announcements of their meeting minutes and Governor Philip Lowes statement had the largest effects. The RBA Announcements came early in the week, with the latter half experiencing some choppy behaviour, the mixed news releases gave the aussie a chance to slide during the Japanese banking holidays on Thursday and Friday.

The statement from the Reserve Bank of Australia’s Governor Philip Lowe, indicated the RBA’s position on thinking about further monetary policy easing to support the economy. He noted that monetary and fiscal policy was supporting the economy and that there were strong foundations to aid in the recovery efforts, but that the banks primary concerns were COVID-19, the labour market and inflation.

Interestingly while Gov Lowe ruled out the possibility of negative rates, he did allude to the idea of dropping the interest rate further. Currently the Australian interest rate is the lowest that it has ever been at 0.25%, Gov Lowes statement was interpreted by many that he had suggested that the RBA could very well lower the rate by a further 10 basis points. The actual statement simply made a comparison to other central banks, and that the current 0.25% is really as low as Lowe will go. Theoretically if he did drop the rate further then it would put the rate at 0.15%.

Aspects of his speech felt like he was jawboning, in an attempt to talk the currency down, which if that was his overall goal has spectacularly backfired, as the AUDUSD rose. Considering his statement and the current RBA stance, I feel it is unlikely for interest rates to be dropped further.