As the world progressively goes into lockdown to contain the widespread of the coronavirus, investors are facing the unfortunate reality that the next couple of months will be a struggle. Death tolls are increasing exponentially, which means lockdown or stringent quarantine measures are poised to last longer than expected.

Investors are pricing a global recession!

Weekend Updates

It was a hectic weekend where investors were struggling to keep up with the pace of the spread of the virus and the governments’ unprecedented actions to protect the economy. Given that Europe is now considered as the epicentre of the virus, much of Europe is in various forms of lockdown.

Australia and the US were dominating headlines as the virus spread rapidly to different states. New cases have substantially increased with many more cases going undetected due to a lack of testing kits.

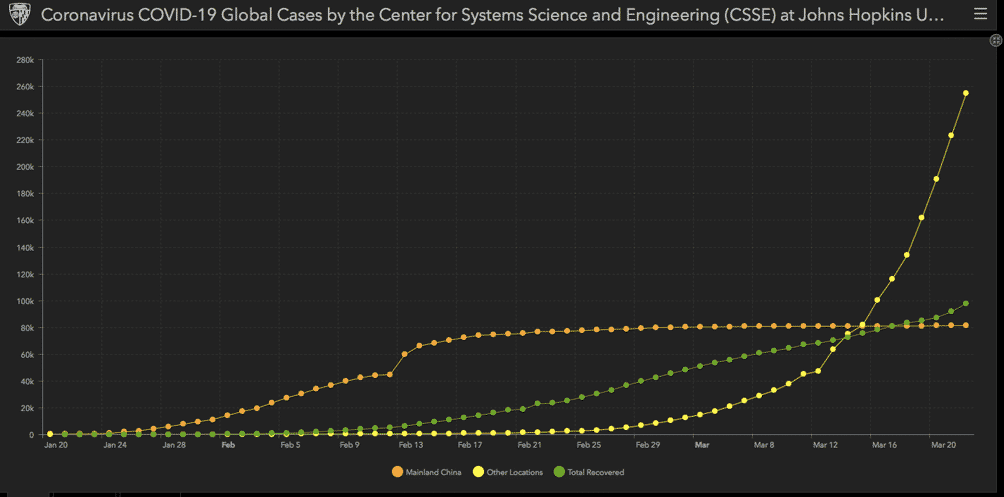

In a nutshell, it took around two and a half months to reach around 100k coronavirus cases, but in the last week, the number of cases has increased rapidly, as shown below.

Australia heads for lockdown

In the FX market, the US dollar gathered strength against all the G10 currencies.

Non-essential services like indoor entertainment, sporting, and religious venue will be closed down as of midday on Monday. Over the weekend, Australia has also unveiled a $66 billion stimulus package for workers and businesses as the Prime Minister warned the population of a difficult journey in the next six months.

ASX200 – Trading Halts and Downgrades

It was a brutal open for the Australian share market. As the country is slowly easing itself into lockdown to fight the virus, many companies are downgrading forecasts while some went into trading halts. It was an erratic morning where the Index continues its freefall and dropped more than 8%.

The Australian Dollar to Remain Under Pressure

The local currency fell to a multi-year low against the US dollar. Faced by such an economic shock, the Aussie dollar is struggling to find upside momentum as investors are rushing into the greenback, which is considered more liquid.

Besides the Commonwealth Bank Manufacturing PMI preliminary figures, the Australia economic calendar is empty. As of writing, the Aussie dollar is buying at 57.10 US cents as it failed to hold on to the bullish gap gains made on opening.

Senate Blocks Phase 3

In the US, Senate Democrats have blocked the Phase 3 Emergency Stimulus Package, which is a trillion-dollar plan. As of writing, it was reported that Congress is moving towards the final stage of negotiations. The Monday open in the US markets will be highly driven by the status of the stimulus rescue, as investors are awaiting the actions that would support the US economy as it faces the worst period of the crisis.

Central Banks and Governments Stimulus

In an attempt to curb the fallout, central bankers and governments are using a combination of various policy tools to provide relief to the global economy. Trillions of dollars are being injected to stem the crisis not seen in years.

Australia and New Zealand have joined the QE wagon!

US Dollar and Gold as safe-haven

Rate cuts and quantitative easing combined with massive fiscal boost are providing support to the global economy – poised to go into recession towards the second half of the year. Uncertainties prevail as investors are struggling to forecast the length of the outbreak.

Some governments are even enacting measures to support ailing sectors or citizens without precedents, which means investors will be busy analysing the different and unusual efforts of each country will be enough to support their respective economy.

Investors are navigating in unknown territory with many uncertainties for the near future. The slowdown is everywhere from restaurants, leisure and sports activity, cinemas, shops, roads, and flights among many others. Investors will likely closely watch intervention measures as more stimulus is warranted to calm down the freefall.

The US dollar remains the King, while gold is being liquidated. Compared to the previous week, the currency markets are now facing the same volatility. Traders are piling up in currencies where enough stimulus measures are being deployed to stem the crisis. The US dollar is the biggest winner as it is being seen as less risky compared to others.

Investors are fleeing riskier assets and piling up in US dollars. Faced with a shortage of US dollars and high demand driven by fear and panic, the greenback will likely maintain its bid momentum compared to its peers in the near term.

Gold is mainly being sold-off for cash or liquidity purposes. The XASUUSD pair erased all the gains made this year. As of writing, the pair is trading slightly below the psychological level of $1,500. However, the precious metal is finding support around those levels and might see room to rise with more stimulus programs.

Economic Data

Even though the focus is without much doubt on the virus crisis and the various massive fiscal and monetary stimulus packages, investors will likely keep a look at the economic releases to gauge the state of the global economy before the worst part of the coronavirus crisis has hit the markets.

Monday

Chicago Fed National Activity Index (US)

Tuesday

Commonwealth Bank Manufacturing PMI (Australia)

Leading Economic Index (Japan)

Markit Manufacturing, Services, and Composite PMI, and Constitutional Court Ruling on ECB QE Legality (Germany)

Markit Manufacturing, Services and Composite PMI (Eurozone)

ZEW Survey – Expectations (Switzerland)

Markit Manufacturing and Services PMI (UK)

Markit Manufacturing, Services, and Composite PMI, and New Home Sales (US)

Wednesday

Trade Balance, Exports, Rate Statement and Interest Rate Decision (New Zealand)

IFO – Business Climate, Current Assessment, and Expectations (Germany)

Consumer and Producer Price Index, and Retail Price Index (UK)

Durable Goods, Nondefense Capital goods, and Housing Price Index (US)

SNB Quarterly Bulletin (Switzerland)

Thursday

Gfk Consumer Confidence Survey (Germany) Economic Bulletin (Eurozone)

Retail Sales, BoE MPC Vote, Asset Purchase Facility, Monetary Policy Summary, Interest Rate Decision and Minutes (UK)

GDP, Jobless Claims, and GDP (US)

Friday ANZ – Roy Morgan Consumer Confidence and Total Filled Jobs (New Zealand)

Consumer Price Index (Japan)

KOF Leading Indicator (Switzerland)

Core PCE, Personal Income and Spending, and Michigan Consumer Sentiment Index (US)

Harmonized Index of Consumer Prices (Germany)

|

Indicative Index Dividends – Tuesday 24 March 2020

|

|

Index

|

Dividend

|

Index

|

Dividend

|

|

ASX200

|

1.014

|

WS30

|

0

|

|

US500

|

0.234

|

US2000

|

0.048

|

|

NDX100

|

0.165

|

CAC40

|

3.335

|

|

STOXX50

|

0

|

ESP35

|

1.689

|

|

ITA40

|

0

|

FTSE100

|

0

|

|

DAX30

|

0

|

HK50

|

0

|

|

JP225

|

0

|

INDIA50

|

2.962

|