Risk sentiment was dented by the number of cases and the death toll:

- Total deaths in the US rose above 4,000

- A total number of cases in the US reached 211,408 with New York being the epicentre of the virus.

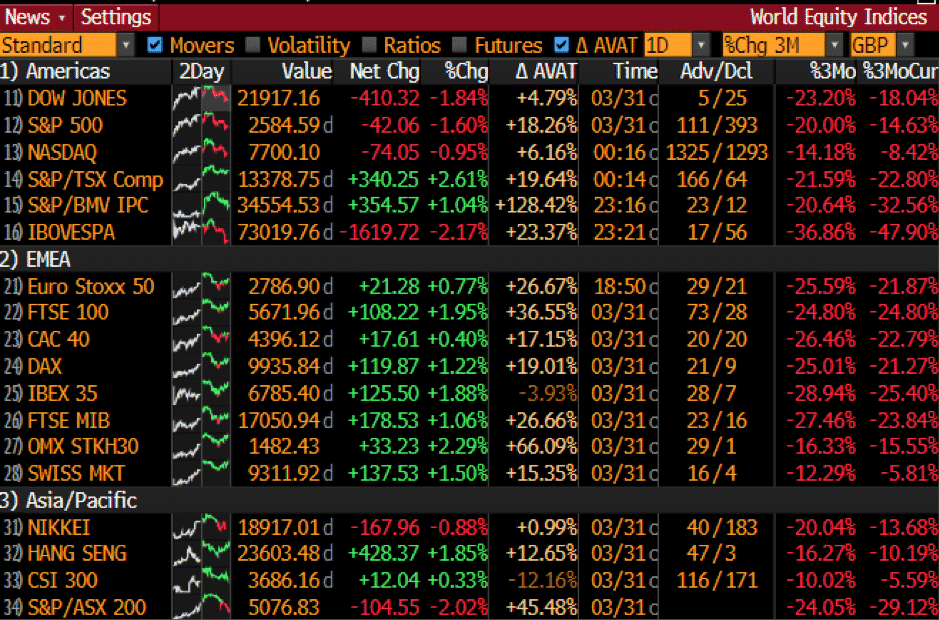

Major US equity benchmarks finished deep in the red as the widespread of the virus sparked fears that the country will stay in lockdown for a longer period than initially anticipated:

- Dow Jones Average Industrial lost 974 points or 4.44% to 20,944

- S&P500 fell by 114 points or 4.41% at 2,471

- Nasdaq Composite ended 340 points or 4.41% lower at 7,700

World Equity Indices (% Change)

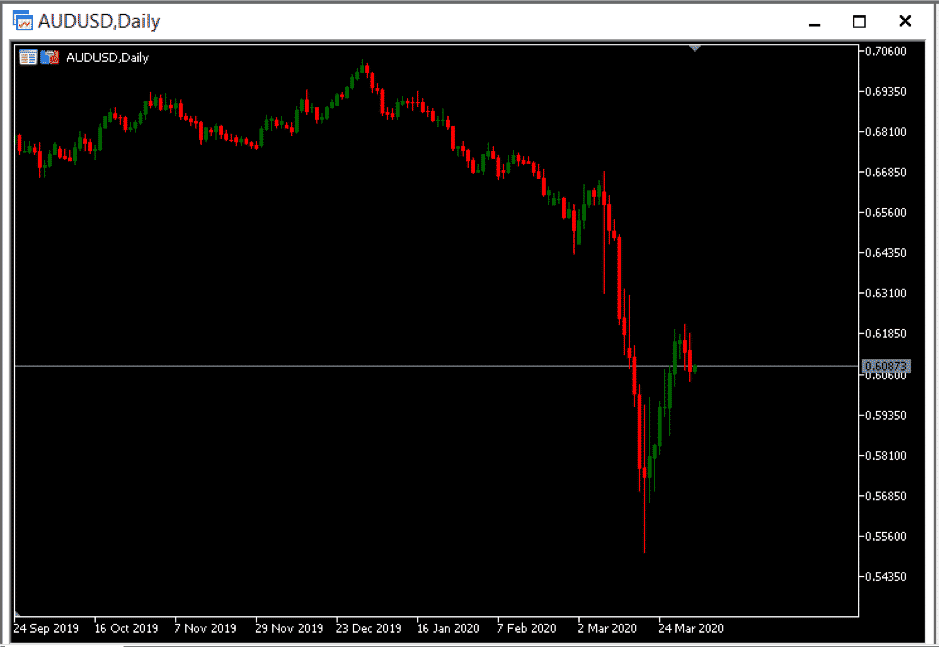

In the FX market, major currencies were weaker against the US dollar. While investors continue to buy haven currencies, and commodity-related FX pairs remained under pressure dragged by a rout in oil prices.

The Australian dollar is struggling to find support around the 0.6000 level. Amid a relatively empty calendar, the pair will be left at the broader sentiment of the market.

The oil market is finding little relief as traders took note of another bearish oil report on Wednesday. The Energy Information Administration reported a substantial increase in the stock of crude oil by 13.834 million barrels for the week ending March 27 versus the previous draw of 1.623 million barrels.

As of writing, the WTI and Brent crude oil are currently trading in the vicinity of $21 and $22 respectively.

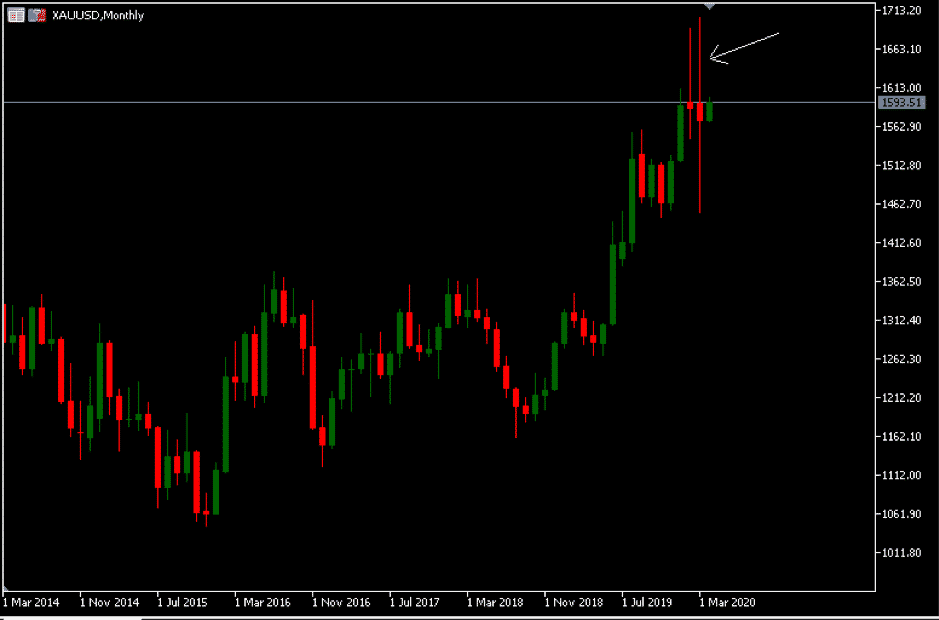

The yellow metal was firmer on Wednesday and closed at $1,590. Despite a stronger US dollar, a combination of positive fundamentals driven by increased demand and supply disruptions, and rescue packages is still creating a positive environment for the precious metal.

In the near term, the precious metal might face another round of liquidation as investors rush for cash. As of writing, the XAUUSD pair is currently trading at $1,593 but the outlook broadly remains skewed to the upside.

The spinning top candle on the monthly chart shows the indecisiveness in the gold market. Currently, at the top of an uptrend, it may signal that bulls are losing their control. Bulls and bears will wait for the next candle for confirmation of a significant trend change.

|

|

Indicative Index Dividends – Friday 03 April 2020

|

|

Index

|

Dividend

|

Index

|

Dividend

|

|

ASX200

|

0

|

WS30

|

6.104

|

|

US500

|

0.341

|

US2000

|

0.015

|

|

NDX100

|

0

|

CAC40

|

0

|

|

STOXX50

|

0

|

ESP35

|

0

|

|

ITA40

|

0

|

FTSE100

|

0

|

|

DAX30

|

0

|

HK50

|

2.998

|

|

JP225

|

0

|

INDIA50

|

0

|