Summary: The Dollar finished mostly weaker against it’s rivals as the US markets returned in holiday-thinned trading yesterday. Sterling surged past one-month highs at 1.2500 (1.2450) against the overall weaker Greenback and on weekend news that UK PM Boris Johnson left the hospital, continuing his recovery from Covid-19. USD/JPY fell 0.56% to 107.75 (108.45) weighed by demand for safe-haven assets. News that the coronavirus outbreak may be nearing a peak in the United States was outweighed by an extremely uncertain outlook as global recession fears continued to dominate sentiment. Gold prices rose to their highest in over seven years to USD 1,713.50 (USD 1,684.00) pressurising the Dollar. The Easter Monday holiday in parts of Asia and through most of Europe saw extremely thin volumes. Commodity-linked currencies finished best performers in FX, with the Australian Dollar climbing 0.68% to 0.6390 (0.6345). The Euro was unable to benefit from the Dollar weakness, finishing modestly lower to 1.0910 (1.0935). Emerging Market Currencies were mostly weaker against the Greenback, presenting a mixed overall FX landscape. An agreement over the weekend by OPEC and Russia to cut oil production by 9.7 million barrels a day through May and June lifted Brent Crude Oil prices by a modest 1.08% to USD 33.50 (USD 33.00) in choppy trade. While the production cut was historic, it fell short of investor expectations for a 10 million barrels/day cut. Significantly reduced global demand for oil kept prices volatile. The Canadian Dollar still rose against its US counterpart, the USD/CAD pair slipped 0.43% to 1.3856 (1.3950), a 4-week low.

Wall Street stocks dipped at the close with the Earnings season due to start today. The DOW was 1.56% lower to 23,420 while the S&P 500 finished at 2,767 (2, 796) 1.09% lower. US Treasury yields rose. The benchmark 10-year US bond yield was up 5 basis points to 0.77%.

Data released on Friday saw US Headline CPI dip to -0.4% in March, lower than forecasts of -0.3%. Core CPI fell to -0.1% against expectations of +0.1%. Earlier in the day, China’s Annual CPI dipped to 4.3%, missing forecasts at 4.9%. Chinese PPI fell to -1.5%, lower than expectations of -1.1%.

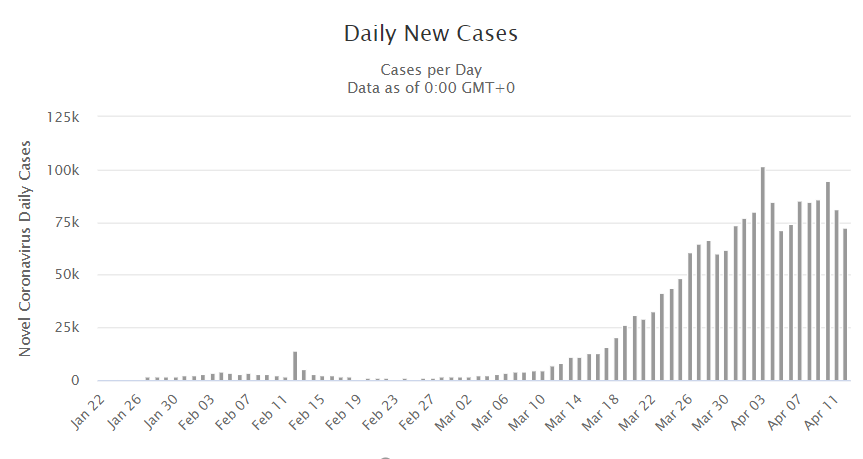

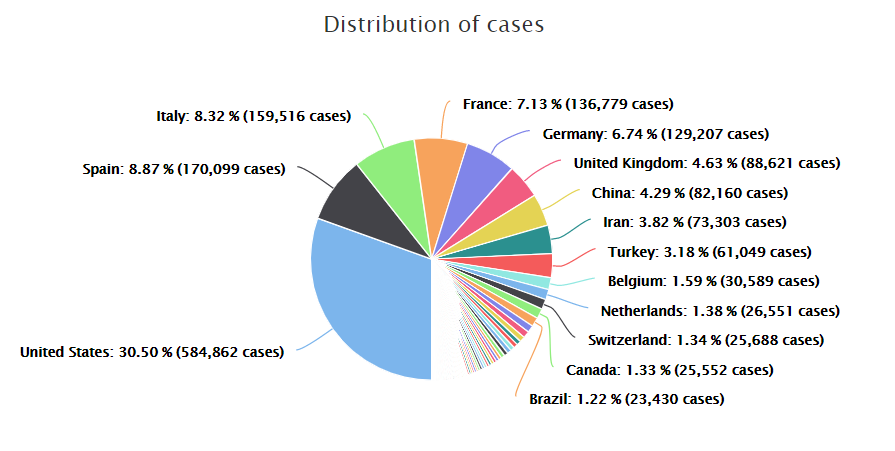

On the Lookout: Traders will focus on the Covid-19 curve flattening in the US, Europe, the UK and Australasia and the prospects of a V-shaped economic recovery. Economic data will be closely scrutinised in the days/weeks ahead.

Today starts off with New Zealand’s REINZ House Price Index and February Visitor Arrival’s. Australia follows shortly with its National Australia Bank Business Confidence Index and Conditions for March. China’s March Trade Balance is today’s main report, both in CNY and USD terms with the breakdown in Exports and Imports. US Import Prices finish off today’s economic data reports. The week ahead sees US Headline and Core Retail Sales (Wednesday), the Bank of Canada Monetary Policy Meeting and Rate Statement (Thursday morning, early), Australia’s Employment report (Thursday) and the CNY trifecta of GDP, Fixed Asset Investment, and Industrial Production. China also reports its March Retail Sales (all on Friday).

Trading Perspective: FX kicks-off today with the coronavirus risk continuing to dominate. While the Dollar stayed mostly on the weak side with commodity-linked currencies like the Aussie, Kiwi and Loonie registering gains, Emerging Market currencies fell. The Euro failed to take advantage of the overall weaker Greenback while Sterling surged to one-month highs. The US Dollar was lower against the Japanese Yen, as demand for havens stayed strong. The uneven FX performance against the generally weaker US Dollar will see more mixed trading before any trend emerges.

We look at the FX market positioning tomorrow in a thin trading week.