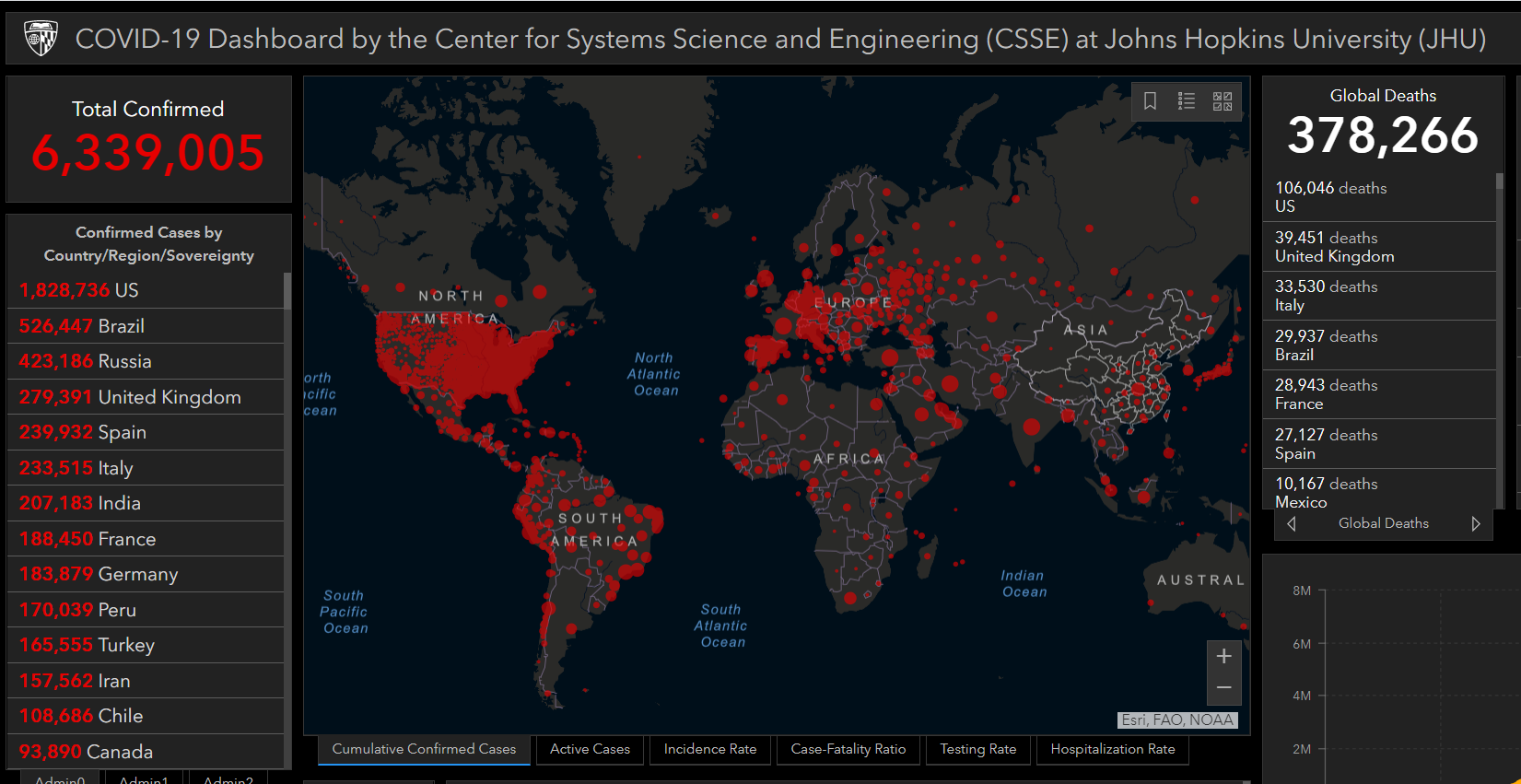

Summary: Market optimism on the economic rebound from easing lockdown restrictions extended lifting risk appetite, equities, and currencies. Ongoing protests in America and Hongkong, and rising number of confirmed total global Covid-19 cases (6,339,005 latest count from Johns Hopkins USA) were once again shrugged off. The Australian Dollar outperformed yet again, climbing to 0.6898, January 17 highs, settling at 0.6895 (0.6795 yesterday), a gain of 1.6%. Against the safe-haven Japanese Yen, the US Dollar soared 1.03% to 108.70 (107.58). The Euro extended its rally against the Greenback to 1.1170 from 1.1135. Despite mounting concerns over Brexit, the British Pound rose to 1.25756 before easing to 1.2550 from 1.2492 yesterday. The USD/CAD pair hit two-month lows at 1.34837, climbing to 1.3517 (1.3575 yesterday) in late New York. Higher Oil prices also lifted the Canadian Loonie. The Dollar slipped against the Offshore Chinese Yuan (USD/CNH) to 7.1075 from 7.1250. The Greenback retreated against Emerging Market FX. USD/ZAR (Dollar-South African Rand) slumped 1.35% to 17.16 from 17.37 yesterday. Wall Street stocks rose for the third day. The DOW climbed 0.97% to 25,747 (25,503) while the S&P 500 added 0.80% to 3,084 (3,058).

Global treasury yields rose. The benchmark US 10-year yield was up 3 basis points to 0.69%. Germany’s 10-year Bund yield closed at -0.42% from -0.43% yesterday.

The RBA kept its policy and Cash Rate unchanged (0.25%) as was widely expected.

New Zealand’s Building Consents in May fell to -6.5%, bettering the previous months downwardly revised -21.7%. Swiss Retail Sales slumped to -19.9%, worse than forecasts at -4.9%. Spain’s Unemployment Change improved to 26.6K, bettering forecasts at 230.3K. UK Net Lending to Individuals in May fell to -GBP 6.9 billon, missing forecasts of +GBP 1.7 billion.

On the Lookout: Markets preferred to shrug-off the potential negative effects of ongoing protests, rise in confirmed global Covid-19 case as well as the US-China tensions. Risk appetite remains strong for the time being. The price action in the risk currencies and USD/JPY pair tell us that markets believe that the economic impact from these events will be limited.

Events and data releases today, depending on their outcome, could unsettle investors.

The Bank of Canada has its rate policy meeting today. The BOC is expected to keep its policy unchanged, and not increase stimulus. This is the last chair for Stephen Poloz (outgoing) as he hands the reigns to his successor, Tiff Macklem.

Australian data today kick off with the AIG Construction Index followed by Q1 GDP, which will be closely monitored. Australia’s Q1 GDP is forecast to have dropped to -0.4% from the previous quarters +0.5%. China rounds up Asian reports with its Caixin Services PMI.

Euro area reports kick off with Swiss Q1 GDP, and Euro-area Services May PMI’s (Spain, Italy, France, Germany) and the Eurozone Final Services PMI. Eurozone PPI and Unemployment Rate are also released. The UK follows with its Final Services PMI. US data round up the day with ADP Non-Farms Employment Change, Final Services PMI, Factory Orders and ISM Non-Manufacturing PMI.

Trading Perspective: While the US Dollar eased overall against its rivals, bar the Japanese Yen, its drop was more pronounced against the Risk and EM currencies. The risk leading Australian Dollar, outperformer for 3 days, could take a breather today. Markets should be wary of this risk rally which is based purely on sentiment. Any disappointment of expectations will see risk appetite sour. Any flash point from the riots in the US and Hong Kong, a second wave of Covid-19 cases in the US (due to the crowds in the protests) and the negative impact of the economic rebound will see a corrective move in risk assets and the US Dollar. “Lest we forget”, these risk events are still very much around us.