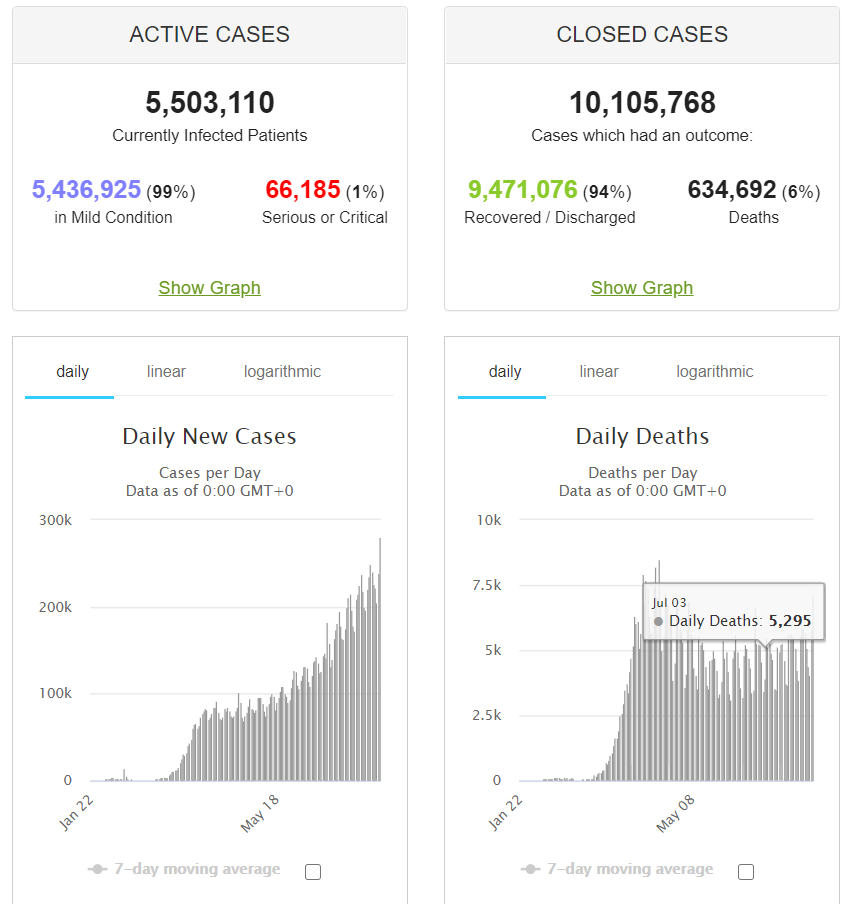

Summary: Risk aversion intensified as the coronavirus spread spiralled higher amidst rising US-China tensions and signs of stalling economic progress. FX responded by purchasing European (EUR, CHF) currencies while selling those associated with risk (AUD, NZD) and Emerging Markets (ZAR, THB, INR). Total US coronavirus cases climbed to 4.162 million with the worrying death count picking up speed above 147,000. The number of Americans filing for unemployment benefits rose for the first time in 4 months last week amid the resurgence of new virus cases. This contrasted with Europe’s ability to control the spread of Covid-19 and the prospect of expected further improvements in Eurozone data. European leaders managed to put their differences aside and agree a robust stimulus package while the US government struggles to get its act together in approving its much-awaited phase 4 stimulus package. The Euro extended its advance to close in New York at 1.1593, (1.1570 yesterday) after hitting a peak at 1.1627, its highest level since October 2018. Against the traditional haven sought Swiss Franc, the US Dollar dropped to 0.92456, a fresh four-month low before settling at 0.9253 in early Asia. FX risk leader, the Australian Dollar slumped 0.62% to 0.7097 (0.7140) on the risk-off mode. Australian Treasure Josh Frydenberg in his budget report yesterday forecast a massive A$ 184.5 billion deficit and a 3.75% contraction in GDP for the 2020/21 fiscal year. Against the Yen, the Greenback slid 0.32% to 106.87 (107.18) weighed by risk aversion and a lower US 10-year bond yield at 0.58% (0.60% yesterday).

The Dollar was higher against the Asian and Emerging Market currencies. The USD/ZAR (Dollar-South African Rand) pair rose 0.98% to 16.67 (16.47 yesterday). Against the Thai Baht, the Dollar was up 0.3% to 31.72 (31.57) while the USD/CNH pair steadied at 7.0110 (7.016 yesterday). Wall Street stocks slumped. The DOW closed 1.25% lower at 26,652 (27,000) while the S&P 500 fell to 3,237 from 3,277, down 1.15%.

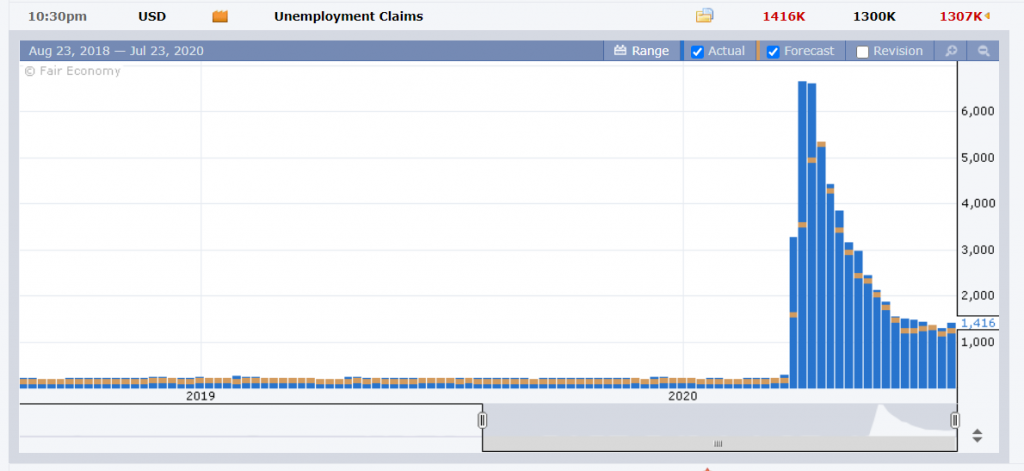

Data released yesterday saw Australia’s NAB’s Quarterly Business Confidence Index slump to -15, underwhelming forecasts at -8. Eurozone Consumer Confidence missed forecasts at -12 with a -15 print. US Weekly Unemployment Claims rose to 1.416 million, beating median estimates of 1.3 million and the previous weeks downwardly revised 1.307 million (from 1.3 million). It was the first rise in Jobless Claims in nearly 4 months.

On the Lookout: Today sees a data dump with the release of global Flash Manufacturing and Services PMI’s. New Zealand kicked off just a few minutes ago with its Trade Balance. New Zealand’s Trade surplus dipped in June to +NZD 426 million from May’s +NZD 1.286 billion, missing median forecasts at +NZD 450 million. The Kiwi did not move from its current 0.6632 level on the release.

Australia follows with its Commonwealth Bank Preliminary Flash Manufacturing, Services and Composite PMI report. The UK is next with its GFK July Consumer Confidence report followed by UK Retail Sales for June. European data kick off with French, German and Eurozone Flash Manufacturing and Services data. The UK reports on its Flash Manufacturing and Services PMI’s. Belgium releases its Business Climate data. The US rounds up the day’s data releases with its Flash Manufacturing and Services PMI’s and New Home Sales.

Improvements are forecast for all the global PMI’s with the largest increases expected from Europe.

Trading Perspective: The Euro has outperformed in FX, climbing against the Greenback in the last nine out of ten days. In just a month’s time, EUR/USD has risen from 1.1200-1.1600. The catalyst for the last break up was the EU’s agreement of its stimulus package which is expected to cushion an improving Eurozone economy. Europe has largely been able to control its Covid-19 outbreak so far.

Today’s release of Euro area and Eurozone PMI’s are expected to show further improvements. While there is no denying that the Euro may be at the cusp of a bigger rally against the Greenback, the market positioning is well long of the shared currency, at the same time extremely bullish at current levels. Meantime, the market’s risk-off stance has seen the Aussie, Kiwi, Asian and EMS currencies fall versus the Greenback. These will eventually merge back together. The conclusion is that the hugely overbought EUR needs a much-needed correction in the short-term for the establishment of healthy medium-term uptrend. A disappointment in today’s Euro area and Eurozone PMI’s could be the catalyst. Another pressure area is that of a stronger USD against the risk and EM currencies.