Summary: The Dollar rebounded after Federal Reserve Chair Jerome Powell shrugged off negative rates when questioned during an event where he spoke at. “The committee’s view on negative rates really has not changed. This is something we are not looking at,” said Powell. On the economy, the Fed Chair said the US could face an “extended period” of weak growth. USD/DXY, the US Dollar Index, a favoured gauge of the Greenback’s strength against 6 major currencies, rebounded 0.29% to 100.223 (100.04 yesterday). Prior to Powell’s speech the Dollar was under pressure against most of its rivals. Earlier in the day, the RBNZ left its OCR (Overnight Cash Rate) unchanged at 0.25% but surprised traders by doubling its intended QE purchase amounts. The New Zealand central bank said that they are prepared to ease interest rates further if needed. The Kiwi tumbled to 0.6005 from 0.6065 immediately, dipping further to 0.5980 overnight before settling to close at 0.5995 in New York. The Australian Dollar also traded lower to 0.6438 from 0.6470 yesterday, trading to 0.6455 in late New York. Australia’s Employment report is due today (11.30 am Sydney time) and a bad number could see further losses for the Battler. The British Pound fared better against the US Dollar, dipping 0.14% to 1.2235 (1.2255) after UK Q1 GDP and other UK data were better than forecast. The Euro retreated 0.25% to 1.0817 from 1.0847. Against the safe-haven Yen, the Dollar was moderately lower to 107.05 from 107.15. Wall Street stocks slipped on Powell’s remarks on the economy. The DOW was 1.08% lower to 23,305 (23,595). The S&P 500 was at 2,825 from 2,847, down 0.74%. Global bond yields were a touch lower, the key US 10-year rate closing at 0.65% (0.67%). Germany’s 10-year Bund yield ended at -0.54% from -0.51% yesterday.

Japanese Economic Watchers Sentiment Index dipped to 7.9 from 14.2, missing forecasts at 10.1.

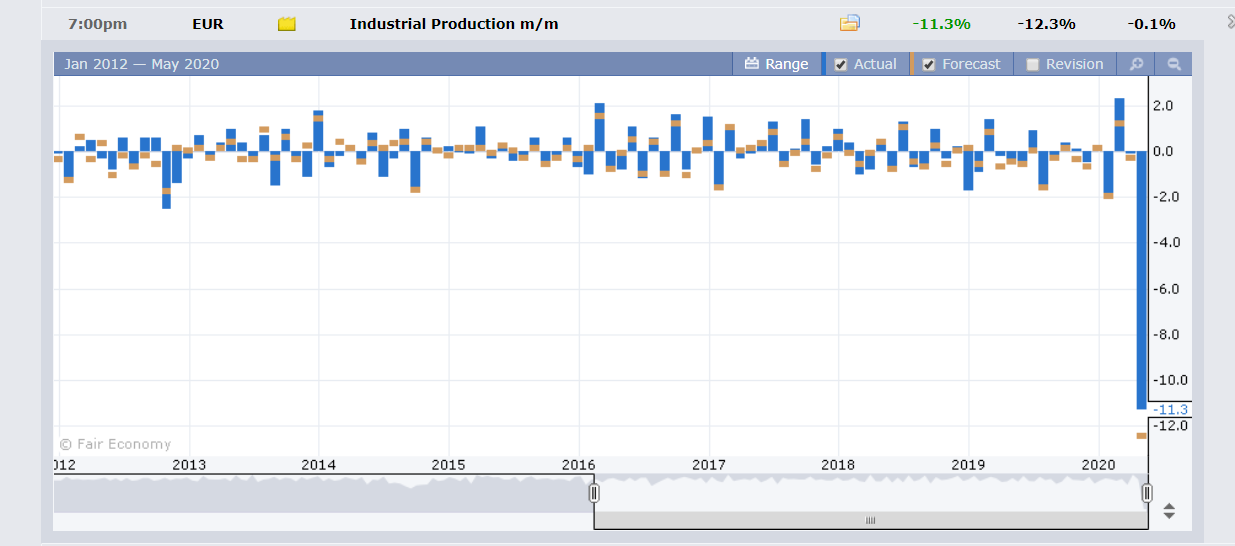

The UK Q1 GDP was at -2.0% from 0.0% in Q3, beating forecasts of -2.5%. UK Manufacturing Production also beat expectations with a -4.6% print against -6.0%. UK April (monthly) GDP also beat forecasts at -5.8% against -7.9%. Eurozone Industrial Production fell to -11.3% from -0.1% (March) beating forecasts at -12.3%. US Headline PPI fell to -1.3% (forecast -0.5%) while Core Producer Prices were at -0.3% against median expectations of -0.1%.

On the Lookout: Data releases today will continue to paint a bleak global economic picture. New Zealand kicks off with its Monthly Visitor Arrivals report. New Zealand will also release its Annual Budget report later in the day. Australia releases its April Employment report, expected to see a loss 575,000 jobs while the Unemployment rate is forecast to spike to 8.3% from March’s 5.2%. China releases its Foreign Direct Investment report. Japanese Preliminary Tools Orders follow.

Euro area reports start off with Germany’s Final CPI and WPI (Wholesale Price Index). Swiss PPI follows. Bank of England Governor Andrew Bailey is due to speak at a financial webinar. Canada reports its Manufacturing Sales for April while the Bank of Canada releases its Financial System Review followed by a speech from BOC Governor Stephen Poloz. The US releases this week’s latest Unemployment Claims report.

Trading Perspective: While the US Dollar has gained the upper hand, its performance is still inconclusive. The Dollar Index (USD/DXY) is still a long way from its March highs at 103.00. The Greenback has been trading in a relatively tight range between 98 and 101.

The US currency faces another test today with the release of the latest weekly US Unemployment Claims report. Jobless Claims in the US are forecast to ease to 2.5 million from the previous week’s 3.169 million. The number is still huge, but it is still better than the previous number.

Australia’s Employment report will also have the potential to move the Aussie which has been stuck between 0.64 and 0.66 cents. We look at the individual currencies.