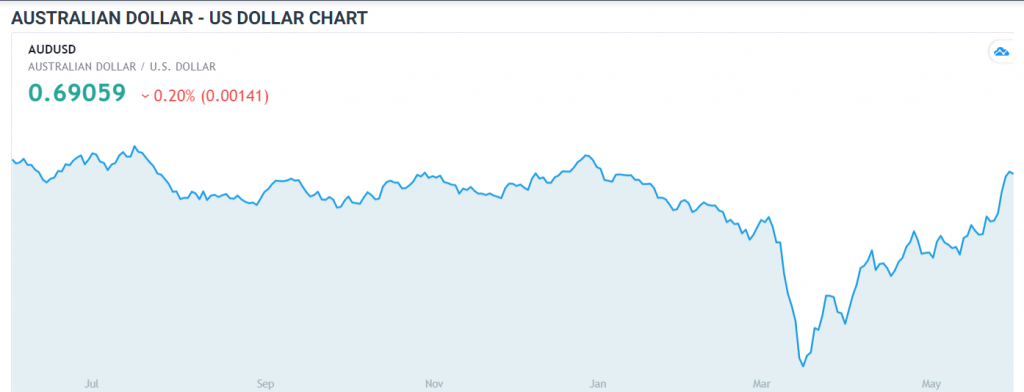

The Australian Dollar eased off five-month peaks at 0.69836 yesterday to finish trade in New York at 0.6922 (0.6900 yesterday). The Battler has enjoyed a strong run of advances in 4 days after a sustained rise in risk appetite boosted stocks and high growth currencies. Yesterday the Offshore Chinese Yuan eased against the Greenback. The USD/CNH pair finished at 7.12 in overnight trade from 7.1070 yesterday which weighed on the Aussie. China-US tensions have remained high and China could allow significant falls in the Yuan should this continue. This would add downside pressure to the Aussie, resulting in a corrective move lower. Better than expected US Weekly Unemployment Claims and US Payrolls tomorrow could lift the US Dollar off its floor against its rivals, including the Aussie.

The latest Commitment of Traders/CFTC report saw net speculative Aussie short bets total -AUD 40,538 contracts in the week ended May 26 from -AUD 39,558, a small rise. Total speculative Aussie short bets are 61% relative to the year’s maximum. This should provide modest downside support. AUD/USD has immediate resistance at 0.6960 followed by 0.6990. Immediate support lies at 0.6890 and 0.6850 (overnight low 0.6857). Look for a likely trading range today of 0.6830-0.6970. Prefer to sell rallies.