The Aussie Battler extended its advance to finish 0.3% higher at 0.6667 in New York after trading to a fresh marginal high at 0.66831. AUD/USD was sold down to 0.66104 overnight lows in late European/early New York trade as risk appetite soured ahead of Trump’s news conference on China. When no new tariffs were announced, traders bought the Aussie Dollar back near its highs at 0.6667 where it finished.

This morning in Asia, US stock futures slumped with the S&P 500 down to 3,021 from the NY close at 3,060. Tensions between China and the US were expected to simmer after the South China Morning Post’s report that the Chinese hardliners had won over the moderate regarding their response to the Americans. US Secretary of State Mike Pompeo criticised the ruling Chinese Communist Party saying that China viewed itself as intent upon the destruction of western ideas, democracies, and values. The RBA meets on interest rates tomorrow and while no change is expected, traders will look into the RBA’s policy rate statement for future guidance.

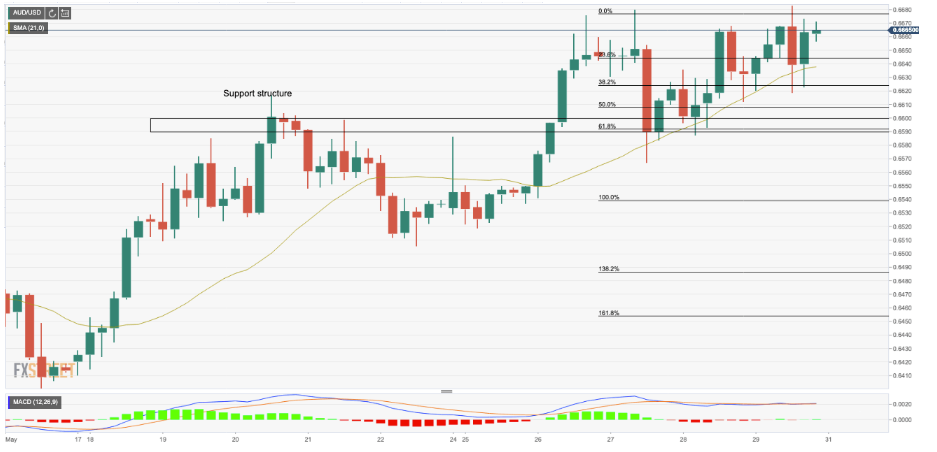

AUD/USD dipped to 0.6655 from 0.6667 on these latest developments. Immediate resistance lies at 0.6685 followed by 0.6700. Immediate support can be found at 0.6620, where solid buying emerged. The next support level can be found at 0.6580. Look for a likely trading range today of 0.6585-0.6680. Prefer to sell rallies.